Car Insurance Rates Kentucky

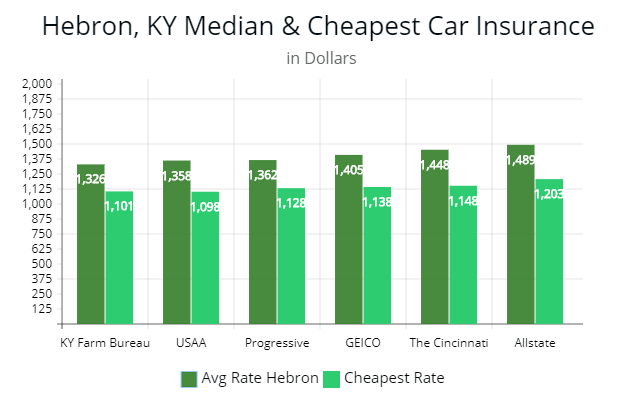

However the variability in rates means kentucky residents should always shop around.

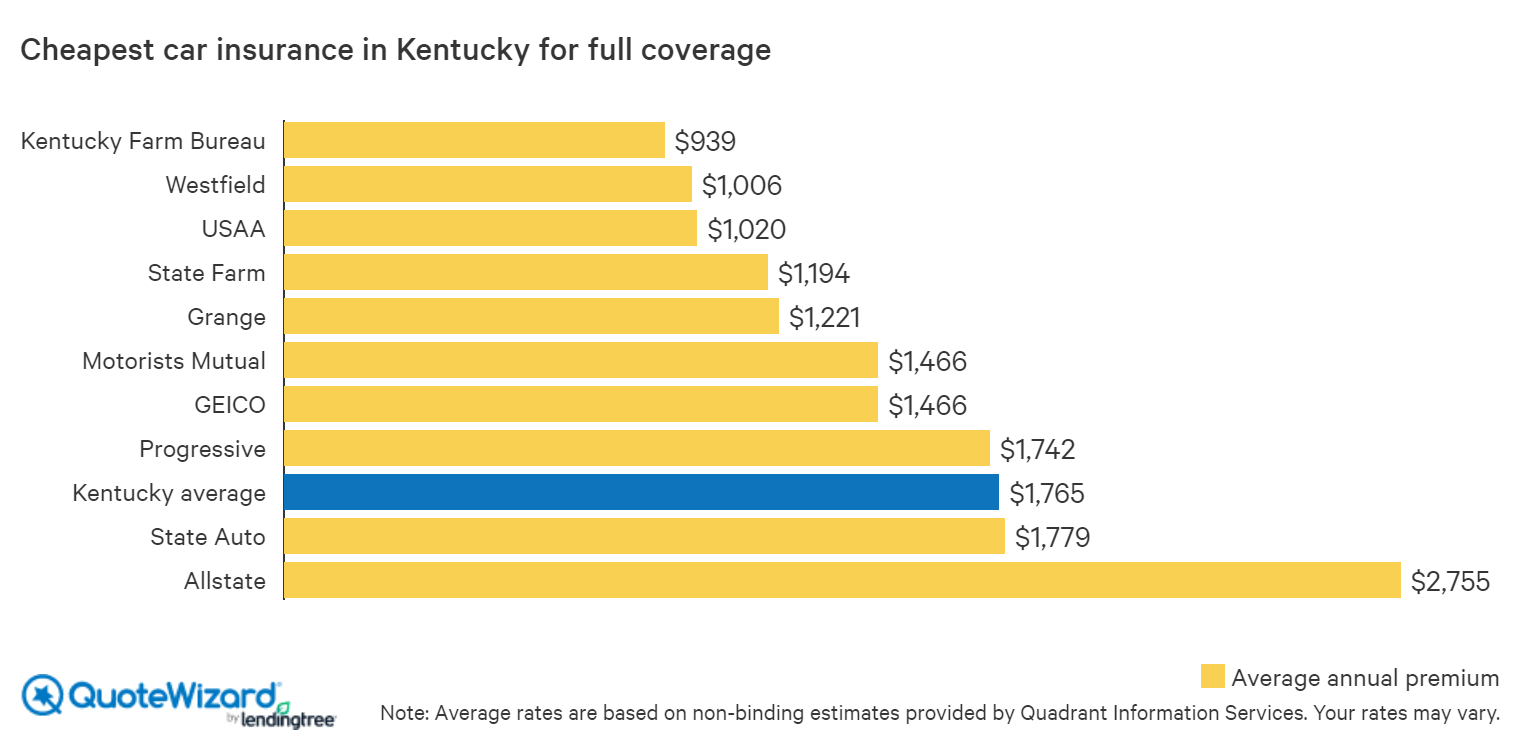

Car insurance rates kentucky. Kentucky s fatal vehicle collision rate is 15 percent higher than the nation as a whole. If you haven t gotten comparison quotes from at least five companies you re likely paying more for insurance than the average driver in kentucky. With a population of over 4 4 million kentucky is the 26th most populated state in the country and features over 167 092 miles of road. Rates are for coverage of 100 000 per person 300 000 per accident in liability and 50 000 of property damage coverage with comprehensive and collision carrying a 500 deductible.

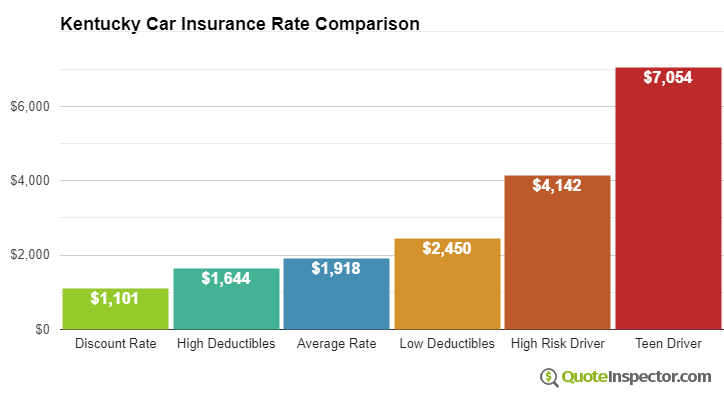

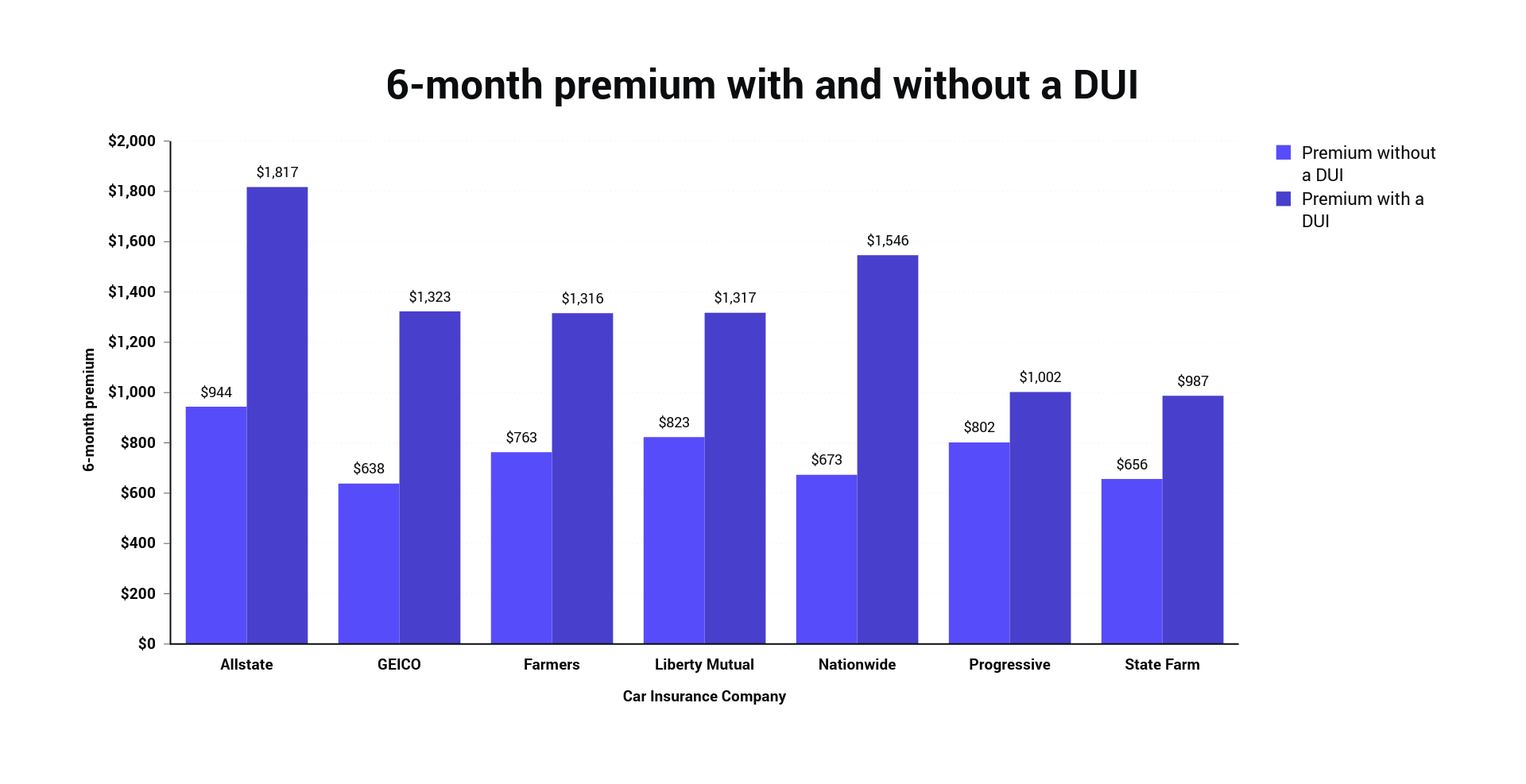

The highest risk drivers pay the highest car insurance rates regardless of state. Columbus ohio business wire aug 6 2020 today root insurance announces that it will eliminate credit scores as a factor in its car insurance pricing model by 2025 moving one step closer to. Based on rate data we gathered for an average driver westfield offers the cheapest car insurance in kentucky for state minimum coverage with its 425 average annual premium. In kentucky a comprehensive policy with a 1 000 deductible costs 1 884 77 more than liability only car insurance.

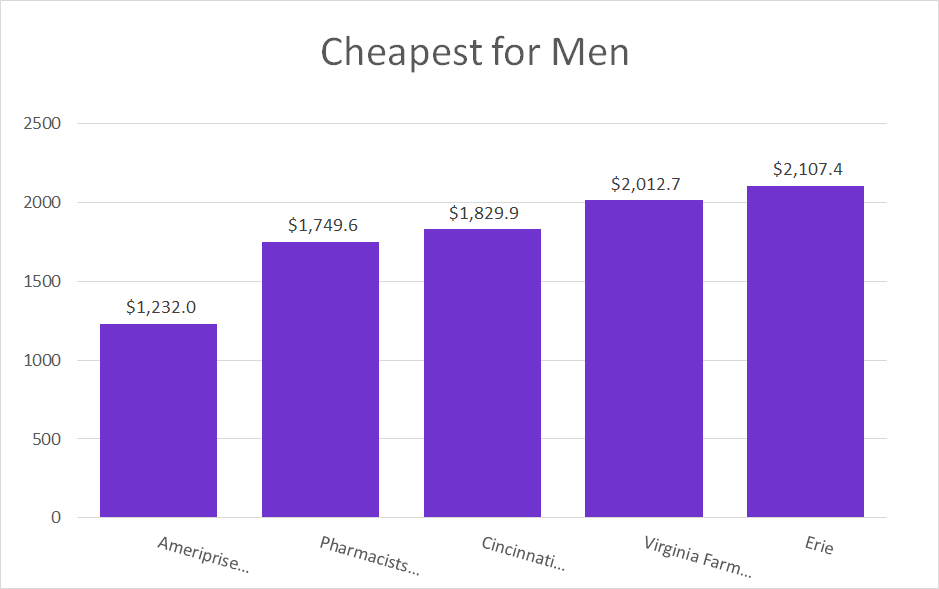

And kentucky farm bureau offers the cheapest rates in the state for full coverage which usually includes liability collision and comprehensive protection with its 939 average annual premium. There are many factors that go into calculating the rate you pay for car insurance. Among these kentucky insurers car insurance rates increased an average of 47 after an accident. For a husband and wife both 50 years old with clean credit and driving records these are the cheapest car insurance companies and their average rates in kentucky for full coverage on two.

Whereas state farm charges drivers 17 more after an accident the smallest increase in our analysis allstate charged drivers 68 more which is the largest increase in our sample. Why car insurance rates vary in kentucky. Better car insurance comes with a price. In kentucky car insurance is mandatory and the state s laws impose minimum insurance requirements.

Bodily injury liability limits are 25 000 per person and 50 000 per accident and property. For a comprehensive policy with a 500 deductible you can expect to pay 94 more than for basic liability only coverage.