Car Insurance Sr22 Ohio

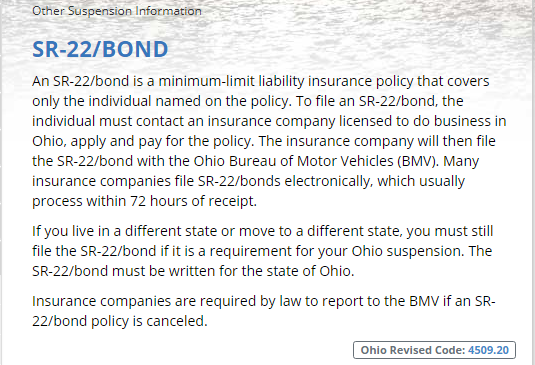

To file an sr 22 bond the individual must contact an insurance company licensed to do business in ohio apply and pay for the policy.

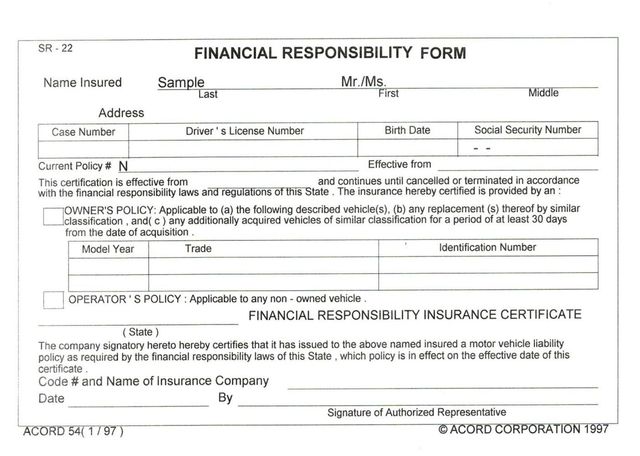

Car insurance sr22 ohio. Sr 22 insurance otherwise known as an sr 22 is a document that is issued by your car insurance company that validates that you carry the minimum liability coverage required by your state. With 1st ohio insurance you ll get. An sr 22 bond is a minimum limit liability insurance policy covering on the person named on the policy. Free quotes online or in person late hours for your convenience access to over 20 different agencies call 216 678 9400 today to get a quote from an independent.

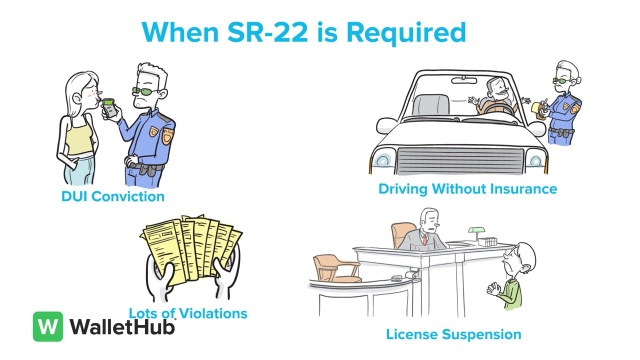

We offer a variety of insurance types including auto sr22 bonds and business insurance through our commercial division all business insurance. The insurance company will then file the sr 22 bond with the ohio bureau of motor vehicles bmv. Sr 22 insurance in ohio in ohio those convicted of drunken driving and other serious traffic offenses must file an sr 22 form with the ohio bureau of motor vehicles bmv. Purchasing sr 22 insurance is a simple way for vehicle owners to prove financial responsibility and reinstate their license.

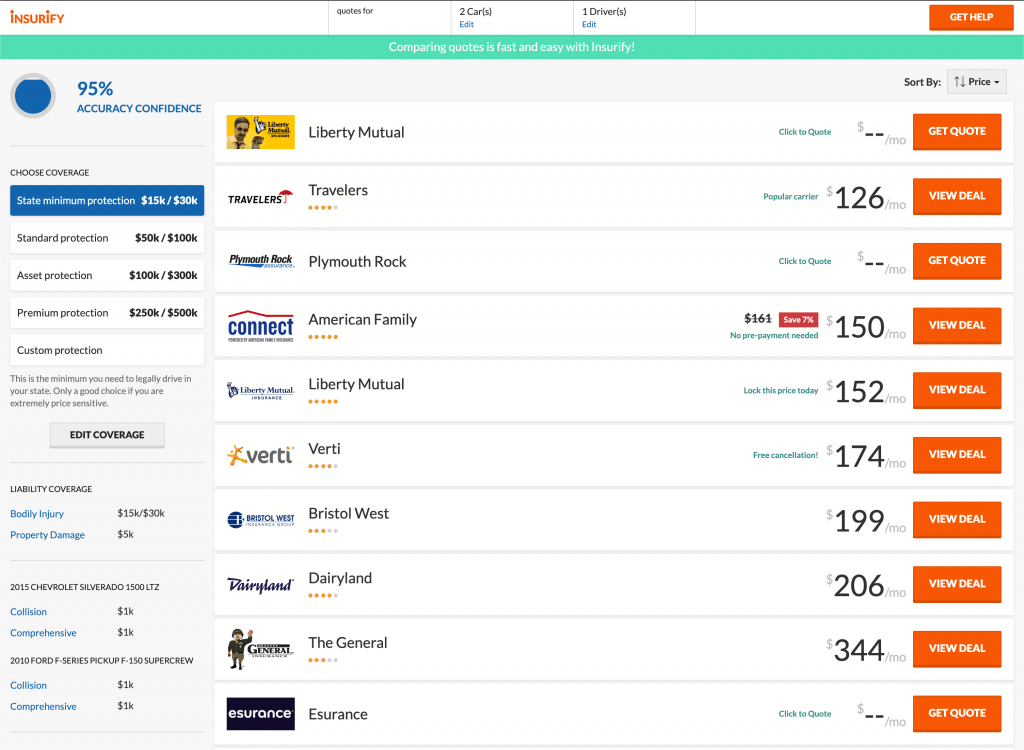

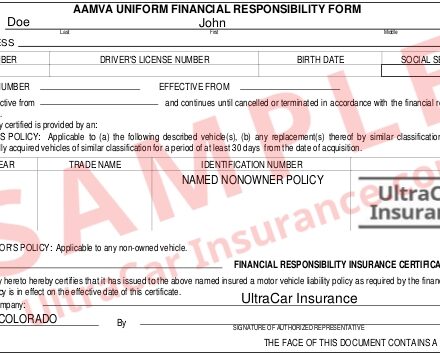

Drivers that have been convicted of moving violations or a dui in ohio may be required to buy sr 22 insurance in order to get their licenses reinstated. If you don t own a car you can get nonowners sr 22 insurance or an sr 22 bond as a cheaper way to provide proof of coverage.