Car Is Total Loss By The Insurance

Some states such as georgia and illinois leave the total loss declaration standards up to the insurance.

Car is total loss by the insurance. This can vary from 50 of the car s pre accident value in iowa to 100 in texas. First of all to be covered for total loss you will need to have property damage liability pd or comprehensive or collision insurance in your policy. The cost of repairs plus the scrap value of the car must equal or exceed the car s pre accident value. This will be the acv of your car plus the salvage value.

Insurance providers label cars as total losses if the cost of repairs is more than the value of the vehicle at the time of the accident. What if the insurer says my car is a total loss. Pd is mandatory in every state but the only way to receive a payout from pd is to file a claim against another driver s pd. Insurance wise the only way for you to get the remaining 15 000 of repair costs would be from your own collision coverage if you have it.

Your insurance company will tell you your car is a total loss for the following reasons. A total loss does not mean a car cannot be repaired. If you live in texas the same car would only be a total loss if the cost to fix it is at least 100 of its value. Either way a total loss accident is usually more complicated than getting a vehicle repaired.

Total loss claims and actual cash value. Additionally if your insurer decides that the damage to your car is so substantial that it cannot be repaired safely it will be deemed a total loss cost. If you accept the cash settlement offer you are basically agreeing to sell your car to the insurance company who will then salvage it for parts for whatever value it still has. Below you ll see total loss thresholds and total loss formulas by.

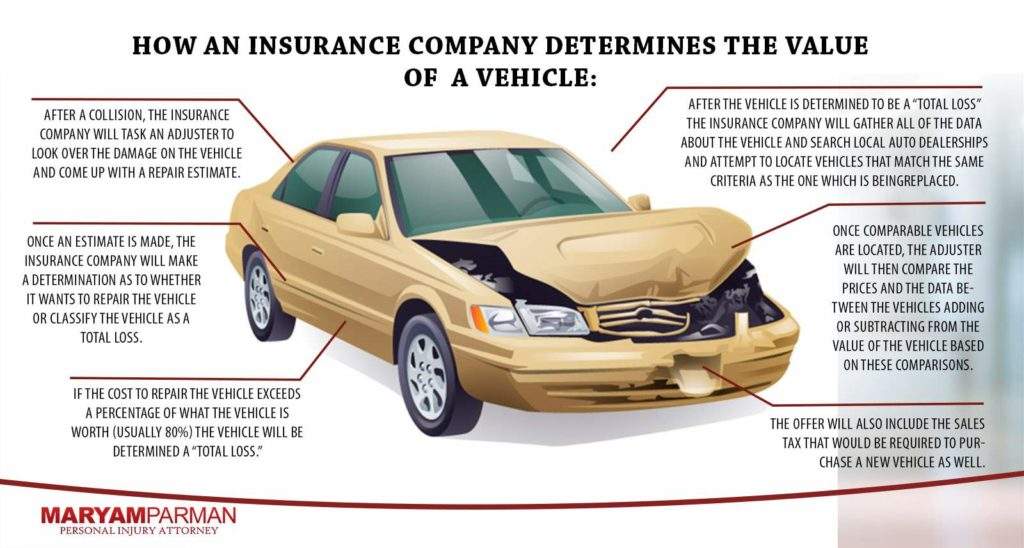

Your insurance company probably had a professional appraiser evaluate the repair cost and market value of the car. Specific definitions can vary from state to state and from insurer to insurer. Many states use something called a total loss formula. Code of practice for disposal of salvage category a your car is a completely burned out ie it has been set fire or has caught fire when only the shell is left and clearly cannot be repaired this is called a category a total loss no retrievable parts.

If the insurer says that your car is a total loss it will only pay you the fair market value of your car as of the day of the accident. After the insurance company declares your car a total loss they ll come to you with an offer for a cash settlement. What is a total loss. If the repair cost approaches 75 percent of the market value the car usually is deemed a total loss.

Car insurance companies label a vehicle a total loss when the cost to repair the vehicle to its pre damaged state exceeds the cost of the vehicle s worth or actual cash value. A total loss auto accident can range from a disastrous collision to bumping a deer depending on the value of the vehicle. It means it is impractical to repair it. This often called a total loss threshold.