Car Lease Tax Insurance

When your contract ends you return the car.

Car lease tax insurance. Can i write off my lease payments on taxes. Gap or guaranteed asset protection insurance is required by nearly all lease contracts it protects both the lessor and you in case the car is totaled or stolen during the lease term. So if you fancy financing a car with insurance included in one monthly payment. Fuel and go is a convenient way to get the vehicle you want with insurance maintenance tax in one easy package.

Car leasing are a credit broker not a lender. Come to the end of the term and you can simply return the car with nothing more to pay as long as you ve stuck to the pre agreed mileage limit and have kept the car in good condition just like with a lease. Car leasing are a credit broker not a lender. Even if the leasing agreement does not require you to have it buying gap coverage is critically important to make up any difference between your contract obligation and the market value.

However as with leasing if you want to hand the keys back at the end of the contract with pcp you can. You can deduct the business portion of your insurance costs for your car. Let s see how the hmrc treats car leasing when it comes to tax relief. The most common method is to tax monthly lease payments at the local sales tax rate.

Yes if you use the actual expense method. Vat registration no 745244042. If your company is leasing a vehicle you don t own it. Nevertheless for cars with co2 emissions above 130g km there s a flat rate disallowance of 15 percent of relevant payments.

That means that you can claim your monthly lease payments as a business expense. Car leasing and next vehicles is a trading style of car leasing limited and the firm is authorised and regulated by the financial conduct authority frn 654390. This can happen if the car is in an accident for example. According to the edmunds 2020 automotive industry report car leasing volume grew from just over 1 million in 2009 to 4 3 million in 2019.

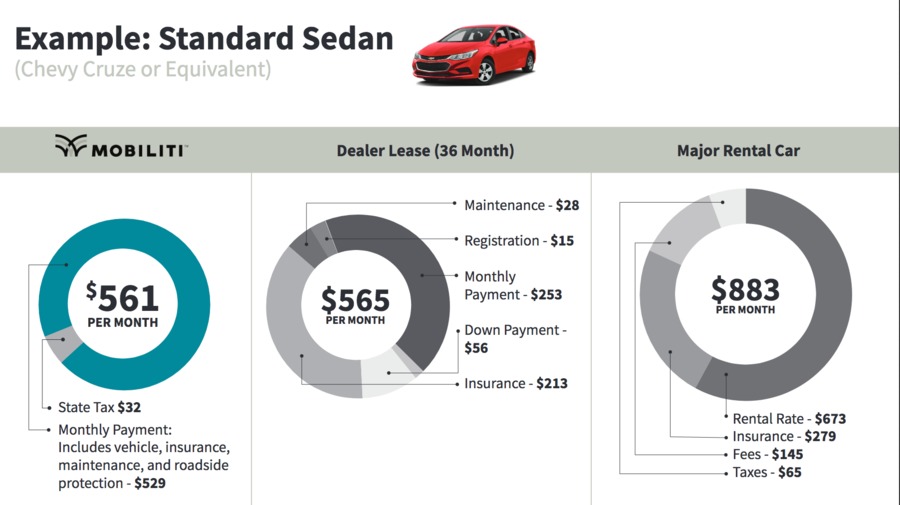

With car leasing the residual value at the end of the lease can lower the lease cost and if you get a closed lease you can walk away without penalty. Buying a car means a loan for a specific amount which you will have to pay back even if the value of the car goes below the amount of the loan. Car leasing is on the rise and although you do not own a leased car there are still important car insurance coverages to consider to make sure you are protected when leasing a car. Car leasing essentially means you rent a brand new vehicle making fixed monthly payments for a set period of time and an agreed mileage.

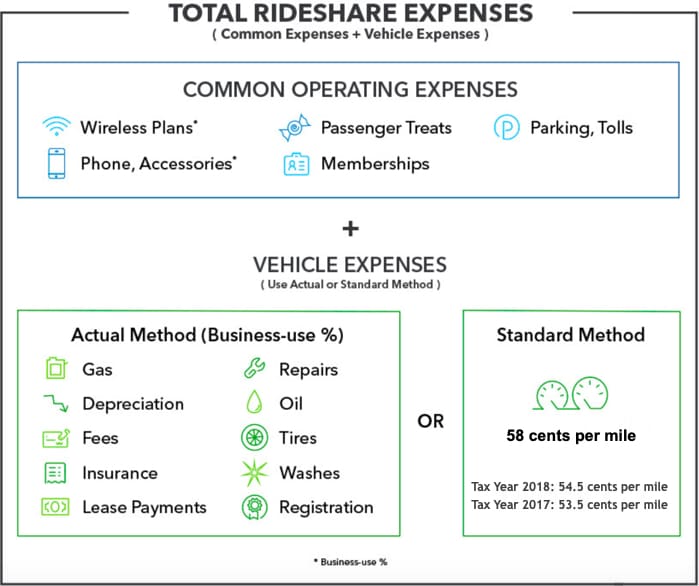

The standard mileage rate already includes costs like insurance gas and wear and tear. Car leasing and next vehicles is a trading style of car leasing limited and the firm is authorised and regulated by the financial conduct authority frn 654390. Vat registration no 745244042.

/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-acec513303ff4fe4ab3d3e7a5c747d77.png)