Car Loan Insurance

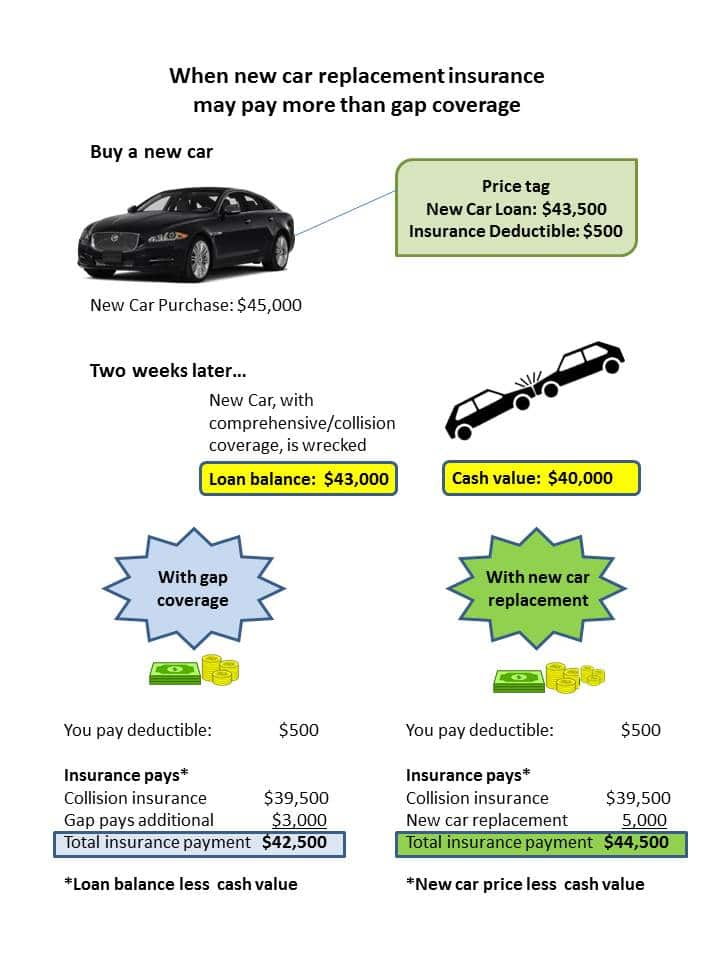

One type of extra insurance you might want to consider is gap insurance which covers the difference between the actual cash value of your vehicle and the current outstanding balance on your loan if your car is totaled.

Car loan insurance. Drive with peace of mind with aviva car insurance which covers your car against loss or damage due to accident theft and flood. When you are applying for your auto loan you may be asked if you want to buy credit insurance. You can protect up to 70 of your gross annual income and payouts will normally be tax free. 60 of the purchase price or valuation price whichever is lower.

Ii the buyer s loan amount is a minimum of s 20 000 over a minimum period of 2 years. If a loan car is damaged in an accident or stolen it must be reported to the loan. Whereas payment protection insurance ppi will typically be attached to one debt you can use loan protection to pay off any debt you choose whether it s your mortgage or credit card repayments. Credit or loan insurance provides coverage that may help you pay off your loan or make your loan or credit card payments in the event of job loss critical illness accident or death.

So if you owe 25 000 on your car and it s only worth 20 000 gap insurance will make up the difference. Credit insurance is optional insurance that make your auto payments to your lender in certain situations such as if you die or become disabled. Extra insurance that s worth the money. We offer three types of car insurance prestige standard and lite so you ll buy only what you need.

Whether the need is due to disability or unemployment this insurance can help cover. Compare car insurance rates with instant car insurance quotes when you buy online. I the buyer s insurance and financing is applied through sgcarmart connect. Third party costs such as dispatch charges s 12 per trip full settlement of outstanding loan charges s 150 per s 50 000 block transfer fees s 25 and admin fees for coe loans may apply.

70 of the purchase price or valuation price whichever is lower s 20 000. A total loss accident a year after purchase would leave you owing more than it s worth even after the insurance payout because most of the payments over the last year went straight to interest. For instance imagine taking out an extended 6 year loan on a car. Gap insurance protects against the depreciation losses of a vehicle that is greater than the balance you owe a creditor on that vehicle.

Loan protection insurance is designed to help policyholders by providing financial support in times of need. Open market value maximum finance amount s 20 000.

/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png)

.png)