Does Car Insurance Cover Fire Damage In India

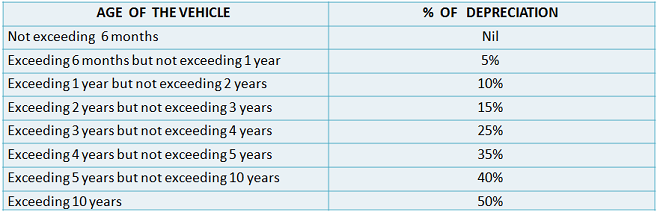

Own damage cover it is the non compulsory own damages cover part of the comprehensive motor policy that actually pays you in case of damage to or theft of your car it is therefore important to understand its scope in detail.

Does car insurance cover fire damage in india. However following is a list of possible car insurance coverages. Car fire from arson you don t often hear about cars being intentionally set on fire but it happens and it would typically be considered a criminal act and at the very least vandalism. If a fire causes 3 000 worth of damage to your car and you have a 500 deductible on your comprehensive coverage your insurance company will pay 2 500 of the costs of repairs. What does car insurance cover.

What is covered in your car insurance policy. Does insurance cover fire damage. Coverage would differ by product. Car insurance or motor insurance is mandatory by law.

Third party cover does not pay for repair of damage to your car or if you suffer any car related injuries. It is also referred to as collision insurance or self damage insurance by some. It is a legal requirement to have a minimal level of insurance before driving a car in india. And you won t need to buy separate fire insurance because you re covered under any standard homeowners renters or condo policy.

Comprehensive auto insurance policy in india gives coverage for theft glass damage vandalism damage sustained from hitting a bird or animal fire damage from falling missiles or objects. Purchasing a car insurance is mandatory in india as per the motor vehicles act.

/GettyImages-200149058-001-577861475f9b585875db0d03.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/two-men-arguing-about-damaged-cars-90201066-57e0914f3df78c9cce0d23c3.jpg)